In the past, many people used Swiss bank accounts as well as other off-shore bank accounts to prevent paying taxes in their own countries. The other fees include ATM charges while the credit and debit cards can attract annual fees. Some of these charges include a monthly fee for using the bank account. You should expect to be charged normal banking fees. Therefore, all the Swiss payments must respect the set standards by the member states. Official proof of address on the other hand is not needed Banking Charges For virtual bank accounts you will need to enter a videocall in which you have to supply your official identification. Note that to open a bank account in Switzerland as a non-resident, you must be at least 18 years old. It allows you to have up to 23 different currencies in your account, including GBP, USD, AUD, CNH and PLN.

#Swiss number account free

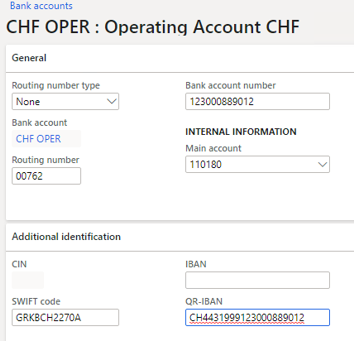

Dukascopy is a free virtual Swiss bank account that you can open from many places in the world, also for non Swiss residents.You also get real-time push notifications for transactions in your account. You can start spending your finances via the mobile app as you wait for your physical card to arrive. This is a German IBAN, but can be used in the same way as any other European IBAN account. N26 comes with personal IBAN and business IBAN in the SEPA zone. N26 is a virtual bank you can use to open Swiss bank account for non residents. Also, landlords can fail to offer you a lease if you don’t have a local bank account. It is because it is challenging to open a bank account in Switzerland without a permanent address. You can open a Swiss bank account online before arriving in Switzerland. If you opt to open Swiss bank account from abroad, it is advisable to have a local representative who can present the documents to the bank on your behalf. Some banks will require you to post the documents via post while others will require you to do personal identification through a video call. It is possible to open a bank account in Switzerland remotely.

#Swiss number account how to

How to Open Bank Account in Switzerland from Abroad Some banks waive fees for a Swiss bank account for non residents for customers who hold large number of assets.Most Swiss banks charge higher fees to customers residing outside of Switzerland and Liechtenstein who want to open a bank account in Switzerland for non residents.You also need to authorize the bank to notify your home country about your banking activities for taxation. You also need to make an initial deposit to activate your account and provide a letter of the correspondent from your home bank. You also need to provide proof that you can pay your bills by providing proof of employment or income. For example, you can open a Credit Suisse non resident account. You can open Swiss bank account as a non resident, but you will need to provide more documents than a resident. Proof of residence using a B or C permit How to Open a Swiss Bank Account for Non Resident.To open bank account in Switzerland, you need the following documents: Documents Needed to Open a Swiss Bank Account The process is very simple for residents, but non-residents can encounter some limitations. 8 Swiss Bank Accounts and Taxes How to Open a Bank Account in Switzerlandīefore you can open a Swiss bank account, it is worth noting that ordinary Swiss banks tend to charge high fees for non-residents.5 How to Open Swiss Bank Account Online Non Resident.3 How to Open Bank Account in Switzerland from Abroad.2 How to Open a Swiss Bank Account for Non Resident.1 How to Open a Bank Account in Switzerland.Click on the BC number to find out the SIC Code, SWIFT Code, bank details, address, telephone number and maps.

The table below are the address and BC number for Credit Suisse branches in Switzerland. Browse Pages : « Prev 1 2 3 4 5 6 7 8 9 10 11 Next »

0 kommentar(er)

0 kommentar(er)